A Safer Way to Save

Lock in Your Savings with a Certificate of Deposit

An account that typically offers you a higher rate of return than a traditional savings account in exchange for depositing your money into the bank account for a fixed period of time.

.png)

Why Invest in a Certificate of Deposit?

Competitive Interest Rates

To help you steadily grow your savings.

Flexible Terms

Because of varying terms and different minimum balances.

No Surprises

Your rate stays locked, so your savings grow predictably.

Current Rates**

Certificate of Deposit FAQs

Answers to Common Questions About Certificates of Deposit

What is a CD?

A CD or certificate of deposit is an account that typically offers you a higher rate of return than a traditional savings account in exchange for depositing your money into a bank account for a fixed period of time, also referred to as a term. You may receive an early withdrawal penalty on your earnings if you withdraw your funds before the term is complete.

How do CDs work?

The total amount of interest you earn on a CD is determined by the term length and your initial deposit. Typically, the longer your term length and the greater your deposit, the higher the interest you’ll earn. Different CD products offer you different term length options and require different initial deposits. CDs are FDIC insured.

What factors affect the rate you earn on a CD?

CDs come in varying terms and may require different minimum balances. The rate you earn typically varies by the term and how much money you have in the account. Generally, the longer the term and the more money you deposit, the higher the rate you are offered.

What’s the difference between interest rate and APY on a CD?

With a CD, just like a savings account, you earn compound interest—meaning that periodically, the interest you earn on your balance is added to your principal. This new total amount then earns interest of its own. The interest rate represents the fixed rate you receive, while the Annual Percentage Yield (APY) refers to the amount you earn, including compound interest.

Is this account insured by the FDIC?

Yes, this account is FDIC insured — for details on what types of accounts and balances are covered, please visit fdic.gov.

Calculate your specific limits at: edie.fdic.gov.

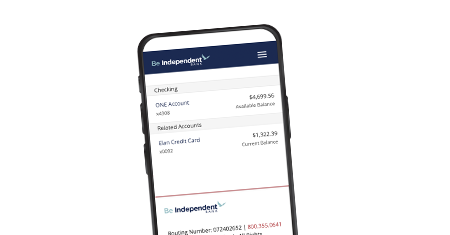

Manage Your Money with ONE Wallet Digital Banking

Get 24/7 access to your accounts with smart tools that simplify banking.

**APY: Annual Percentage Yield. APYs are effective as of 04/23/2025, and are subject to change without notice. Interest will be compounded monthly and will be paid to the account monthly. Deposits into or withdrawals from the CD are not available until the maturity date. Penalty for early withdrawal may be imposed.